IoT Hype is Over: Now It’s Quietly Reshaping Supply Chains

For years, the Internet of Things was more promise than practice in logistics. That has decisively changed. A wave of pragmatic Smartification is now delivering tangible ROI, powered by a maturing technology stack and a sharp focus on moving from simple visibility to tangible automation.

While the hype around the Internet of Things (IoT) has faded, the silence shouldn't be mistaken for failure. On the contrary, IoT technology has moved from the conference stage to the warehouse floor, where companies are quietly integrating it into the backbone of modern supply chains.

This is the current state of IoT in logistics. The revolution is happening, not with a bang, but through the steady, pragmatic work of Smartification: the process of retrofitting previously disconnected analog assets with sensors that enable network connectivity.

Maturing market data, focused investment, and tangible value creation across the industry validate this shift from speculative promise to ROI-driven implementation.

Following the Money: From Hype to ROI

To understand the trajectory of any technology, follow the money. Data on IoT in logistics tells a clear story of maturation: the era of speculative hype has given way to a sharp focus on applications that deliver a tangible return on investment.

This maturity is evident in market data, which reveals two distinct layers of growth. While the foundational market for IoT hardware and connectivity market is forecasted to grow over the next 10 years at a solid 7% CAGR, the true growth story is in the intelligence and automation layer. The market size for AI-driven software and analytics that turn raw data into decisions is outpacing hardware growth by 3x, with a CAGR of 40% over the same period.

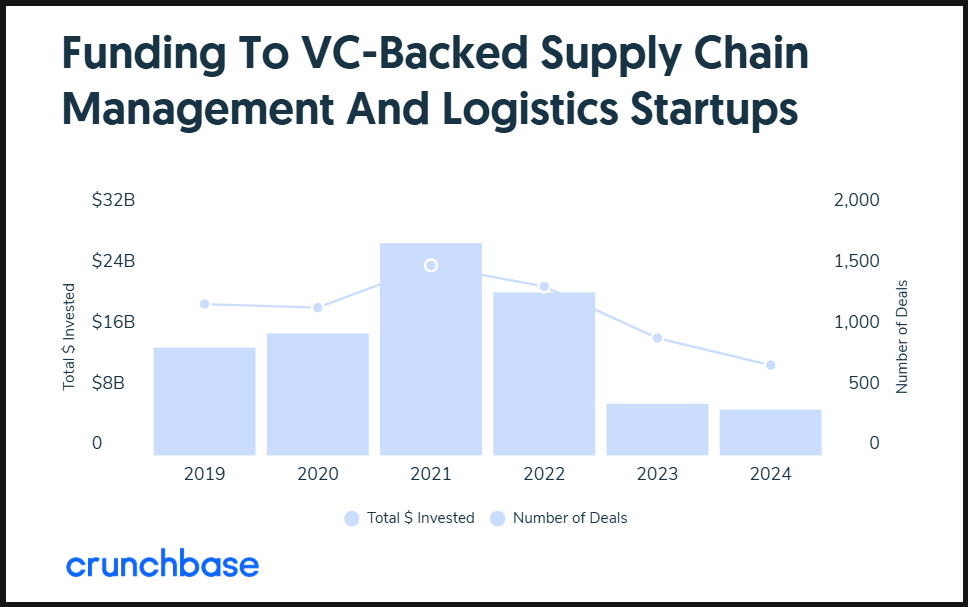

The “flight to quality” away from generic visibility platforms toward operational automation is even more apparent in venture capital trends. After a 2021 peak, overall funding for logistics startups plummeted, falling from nearly $28 billion in 2021 to less than $6 billion in 2024.

Yet this market correction washed away generic visibility platforms, but not the truly valuable technologies. Investment is now concentrating in specific, problem-focused areas like last-mile delivery, autonomous yard vehicles, and AI-enabled warehouse robotics. High-profile funding rounds for companies like Mytra (AI robotics, $78M Series B) and Vecna Robotics (autonomous forklifts, $100M Series C) prove that capital now flows to solutions that directly automate a process and generate a hard ROI.

The lesson for logistics leaders is clear: a successful IoT strategy goes beyond visibility and invests in tangible automation.

Where IoT is Already Driving ROI Today

Beyond market trends, the true test of any technology lies in its real-world application. On the warehouse floor and in the shipping yard, leading organizations are deploying IoT solutions to solve specific, high-cost operational problems. The results are no longer speculative; they are concrete, quantifiable, and directly impacting operational performance.

Use Case I: Asset Tracking & Visibility

Asset loss remains a persistent drain on profitability, with some estimates suggesting 10% to 40% of supply chain assets go missing annually. Logistics operators now use IoT trackers to close this gap, giving a digital voice to previously silent assets.

- Maersk & Hapag-Lloyd: Maersk’s IoT-enabled refrigerated containers have reduced manual inspections by 40% and support network-wide schedule reliability of over 90%. Hapag-Lloyd has equipped more than 85% of its dry container fleet with trackers, enabling real-time location updates that improve inland logistics planning.

- DHL: DHL has deployed over 500,000 smart trackers on roller cages, improving asset distribution and transparency across its network.

- Delta Air Lines: Delta has reached 99.9% tracking accuracy for its RFID-tagged baggage, significantly enhancing the customer experience by reducing lost luggage.

Use Case II: Predictive Maintenance

Shifting from reactive to predictive maintenance yields dramatic results in asset-heavy industries. IoT-enabled monitoring can reduce unplanned downtime by up to 50% and cut maintenance costs by roughly 30%.

- UPS: UPS uses IoT sensors on its delivery vans to monitor engine health and preempt failures, improving fleet availability and reducing costly breakdowns.

- DHL: DHL equips its automated mail sorters with noise sensors that detect anomalies in component performance. This allows maintenance teams to schedule work precisely when needed, avoiding operational disruptions.

- Siemens (Senseye): Siemens, through its subsidiary Senseye, has deployed predictive maintenance systems that reduce equipment downtime by nearly 30% and lower maintenance costs by up to 25%.

Use Case III: Cold Chain Monitoring & Worker Safety

The impact of IoT is arguably greatest in highly sensitive supply chains, where the technology serves a dual purpose: protecting product integrity and ensuring worker safety.

- SkyCell: For temperature-sensitive pharmaceuticals, SkyCell’s smart containers use embedded sensors to maintain integrity, achieving a temperature excursion rate below 0.1% and 0% product loss in transit.

- Lineage Logistics: This cold storage operator used IoT sensors not only to protect perishable goods but also to optimize energy consumption, cutting annual usage by 34% to save $4 million per year.

- Americold: Americold combined IoT sensors with AI-powered video intelligence to monitor workplace safety, resulting in a 77% reduction in injuries and $1.1 million in direct annual savings.

The Infrastructure Behind Scalable IoT

The acceleration of Smartification is not happening in a vacuum. A maturing tech stack is solving the limitations of early IoT rollouts, making scalable logistics IoT possible.

- Private 5G Networks: In dense environments like warehouses, distribution centers, and ports, traditional Wi-Fi often struggles with reliability. Private 5G networks now offer dedicated, secure, and low-latency connectivity for industrial applications. While adoption is not yet widespread, the market is growing rapidly at a CAGR of 40%, with logistics and manufacturing as key verticals. The Port of Tuas in Singapore, for example, uses a private 5G network to operate its fleet of 5G-enabled Automated Guided Vehicles (AGVs), which require consistent communication to function safely and efficiently at scale.

- LEO Satellite Connectivity: Terrestrial networks lack global coverage, with an estimated 80% of the Earth's surface having no cellular service. This creates serious visibility gaps for goods in transit. Low Earth Orbit (LEO) satellite constellations are solving this problem. The LEO market is led by SpaceX’s Starlink, which already serves 2.6 million customers, alongside players like Eutelsat's OneWeb and Amazon’s Project Kuiper. This technology is essential for extending supply chain visibility beyond traditional network boundaries. Maersk, for instance, is equipping its cargo ships with Starlink to enable real-time vessel tracking and improve high-seas operations.

- Edge Computing: Sending the vast amount of data from thousands of IoT sensors to the cloud can overwhelm networks. Edge computing addresses this by handling data processing closer to the source. This is critical for time-sensitive logistics applications that demand real-time decision-making. A hybrid edge-cloud strategy is now considered best practice, where edge systems manage immediate operations while the cloud handles long-term analytics. Key enablers include cloud platforms from AWS and Microsoft and hardware from providers like NVIDIA, whose processors power on-device AI in robots and cameras.

Operational Hurdles Still Holding IoT Back

While the value of IoT is clear, successful implementation is not guaranteed. Understanding these constraints is essential to scaling IoT successfully.

1. The Cybersecurity Imperative

- Challenge: By 2025, an estimated 45% of organizations will have experienced a supply chain attack, and one in three data breaches now involves an IoT device.

- Solution: Addressing this risk demands a "security-by-design" approach. Experts recommend a multi-layered strategy including Zero-Trust Architecture, network segmentation (separating Operational Technology systems from corporate IT), and a disciplined program of continuous monitoring and patching.

2. The ROI Equation: Cost and Integration

- Challenge: 44% of firms cite upfront investment as the biggest barrier to adoption.

- Solution: Well-executed IoT projects deliver a fast, measurable return. Industry benchmarks place the typical ROI for a warehouse IoT deployment at 1-2 years.

3. The Human Element: The Talent Gap

- Challenge: The logistics industry faces an acute talent gap. The demand for professionals with hybrid skills (operational expertise combined with IoT and data analytics) outpaces supply by an 8:1 ratio.

- Solution: Leading companies are solving this by building capability from within. The most effective strategy is to systematically upskill high-potential leaders in data, analytics, and IoT operations.

What's Next for the Connected Supply Chain?

Current IoT deployments are already delivering substantial value by optimizing existing processes. But the next wave of Smartification is moving beyond incremental gains. Two emerging technologies: smart printable electronics and IoT-powered digital twins are expanding the possibilities of supply chain management.

Smart Printables: The Invisible Sensor

The next evolution in IoT sensing involves shifting from discrete, attached devices to sensors embedded directly into packaging. This is made possible by ultra-low-cost, thin, and flexible smart labels, which turn everyday packaging into active data sources.

Smart printables promise to democratize IoT. While most current applications track high-value assets like containers or vehicles, printed electronics make it economically viable to monitor individual items. This shifts the focus from “Where is my container?” to “Where is box #734 inside the container, and has its temperature seal been broken?”

Companies like Wiliot are developing battery-free Bluetooth “IoT Pixel” tags, sticker-sized sensors that harvest energy from ambient radio waves. PragmatIC Semiconductor produces flexible microchips that can be embedded in labels for just a few cents per unit.

IoT-Powered Digital Twins

While smart printables expand what can be tracked, digital twins represent the ultimate application of that data. A digital twin is a real-time virtual model of a physical asset, process, or supply chain that continuously updates based on IoT sensor data. These systems provide a digital environment to simulate, optimize, and stress-test decisions before acting in the real world.

Unilever has already deployed digital twins in multiple manufacturing facilities. These twins receive live sensor data from production lines, which AI and machine learning systems use to simulate and optimize workflows. In one pilot in Brazil, the company saved $2.8 million in operating costs and increased productivity by 3%.

The Strategic Takeaway: From Visibility to Automation

The evidence is clear: the era of speculative hype surrounding the Internet of Things is definitively over, replaced by a period of pragmatic deployment that is delivering foundational value to the logistics sector. The Smartification of the supply chain is well underway. The core lesson from this shift is that the strategic goal of IoT has matured. It is no longer enough to achieve simple visibility; the true value lies in using real-time data to drive tangible automation.

For industry leaders, capitalizing on this reality requires a strategic approach focused on four key actions:

1. Reframe IoT Investment Beyond Direct Cost Savings.

Justify initial projects with hard-cost ROI, such as lower energy consumption or fewer equipment breakdowns, but position this as the first step. The long-term strategy must build toward higher-value outcomes like enhanced customer retention, improved safety, and new data-driven services.

2. Invest at the Point of Automation.

The most successful and highest-ROI IoT deployments are those where data immediately triggers an automated or AI-driven action. The lesson from venture capital's "flight to quality" is instructive: investment should flow to solutions, not just visibility. Instead of funding a generic tracking platform, leaders should champion investments in "predictive maintenance for the vehicle fleet" or "automated yard management," where IoT is a core component that automates a decision and reduces manual intervention.

3. Build the Infrastructure for Scalability.

A truly intelligent supply chain requires a holistic connectivity and computing strategy. Leaders should not view Private 5G, LEO satellites, and Edge Computing as standalone upgrades. Together, they form the backbone of an intelligent logistics infrastructure, providing the reliable and responsive foundation needed to support next-generation applications.

4. Solve the Talent Gap by Creating It.

The scarcity of professionals who combine deep operational expertise with data science skills is a critical constraint. Instead of solely competing in an expensive external market, the most strategic approach is to build this capability from within by launching dedicated programs to upskill high-potential employees.

A Note from the Editor: Is your fulfilment strategy ready for what’s next? Subscribe to our weekly newsletter, (Supply) Chain of Thought, for strategic insights at the intersection of commerce, technology, and logistics.